Learning how to handle money

RESEARCH PROJECT

2018

How might we teach children to manage their money responsibly with the help of a family banking app?

CHALLENGE

In this project we were tasked with planning and conducting a focus group with four young teenagers to gain insights for a family banking app.

This app was supposed to help kids and teens to keep track of their money. It should also provide a framework for learning how to save money and handle it responsibly.

APPROACH

Getting to know the target group

We had relatively little concept of the age group we were going to work with, so we did a small number of upfront interviews. These were rather open conversations about everyday encounters with money.

PROJECT TEAM

Franziska Braun

Vanessa Kammerbauer

Mona Konietzny

Johannes Lager

Jana Lupus

KEYWORDS

focus group, qualitative research, playful research methods

APPROACH

Getting to know the target group

We had relatively little concept of the age group we were going to work with, so we did a small number of upfront interviews. These were rather open conversations about everyday encounters with money.

Having gained a better idea of how this age group thinks about money and what kind of financial interactions are important to them, we devised an interview guideline including different playful tasks that we hoped would inspire the kids to share their thoughts.

EXECUTION

Research setting

We had the opportunity to conduct our focus group within the UX Lab of Fraunhofer IAO in Stuttgart. We were provided an interview room, that was equipped with multiple video cameras and microphones. That way, two of our team members could carry out the test, while the other four were able to observe and take notes from the adjacent room. I was one of the two interviewers.

Our participants were four 13-year-old students who attend the same school together in Stuttgart.

Tasks

We started with a simple warming up task where every teen was asked to recount a recent incident they had experienced with money.

After showing the teens an introductory video (a clip about a competitor’s already existing financial app) we went on to more in-depth tasks where we explored everyday needs and struggles and discussed possible features of our family banking app.

We closed with a final summary of every participants thoughts and impressions.

1.

Warm-up

PURPOSE

Introduce moderators and participants,

lay ground rules

2.

Introduction

PURPOSE

Introduce topic

TASK

Write your name on a piece of cardboard and draw yourself in a recent situation that included money

QUESTIONS

Explain your drawing.

How did you feel in this situation?

3.

Transition phase

PURPOSE

Explain research

TASK

Watch a video clip about an existing financial app

QUESTIONS

Explain what you just saw.

How could an app like this help you, personally?

4.

Key phase

PURPOSE

Explore user needs

TASK

Draw a problem you experience with money

QUESTIONS

Explain your problem.

How do you usually handle this problem?

TASK

You have 10 blocks of Lego. Think fo 3-4 things you spend most of your money on. Try to divide the legos in a way that shows how much you pay for these things comparatively

QUESTIONS

How do you usually plan your budget for these things?

Did you ever run into problems with the amount of money you had available?

TASK

Try to express your savings behavior with the legos in front of you

QUESTIONS

Explain what you have built.

5 Why?

TASK

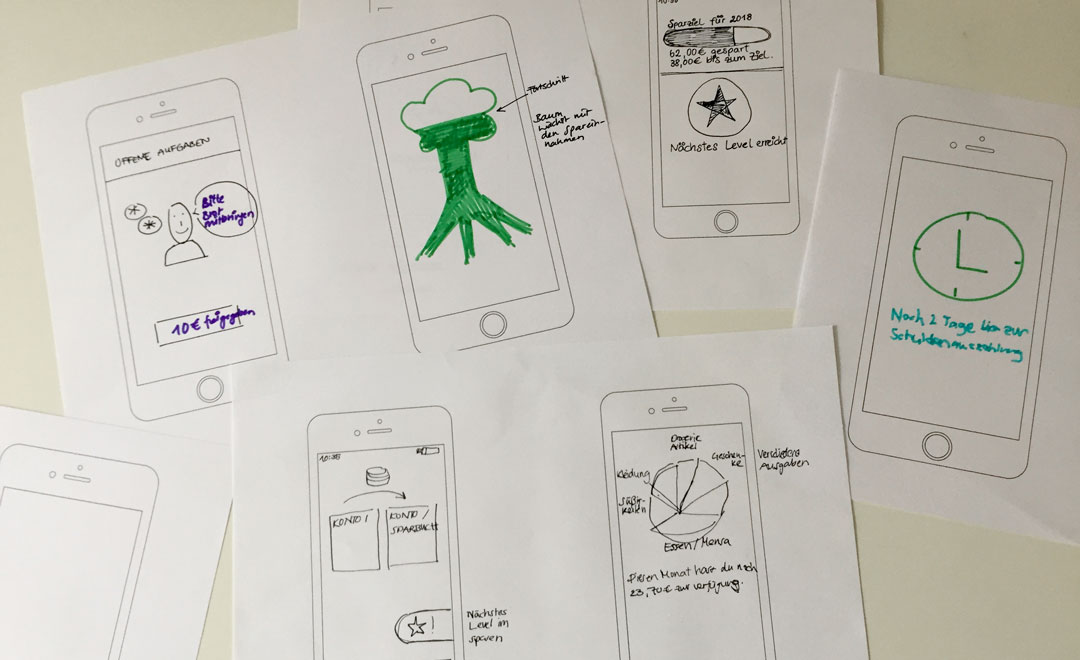

Think of all the situations with money we have talked about. Draw up a screen of what you would like the app to do for you in one of those situations

QUESTIONS

Explain your drawings.

5.

Wrap-up

PURPOSE

Summarize and finish discussion

A task that was particularly fruitful was letting the teens draw their own ideas into a phone screen template. They were able to draw inspiration from apps they had already been using and started to compare them to possible features in the family banking app. This way, a lively discussion unfolded about useful and not so useful features, and the building of trust within the app.

Asking the teens to visualize their own savings behavior lead us to a conversation about hopes and dreams for the future and the values they were taught by their parents.

RESULT

We summarized our finding in a list of required features or characteristics for the family banking app.

Saving

- determine saving goals and modalities

- competing with siblings and friends, get rewards from parents

- “feeding” the app and watch your savings grow

Budget planning

- release only a previously determined amount for certain purchses (e.g. clothes, fast food)

- virtual limits are determined by parents or kids depending on age

Building trust

- data security

- no ads

- a not too “childish” look

Parental control / intervention

- Determining amount of pocket money

- Unlock specific amounts for previously agreed upon purchases

Growing responsibility

- Give children increasing freedom and room to fail

- Kids have to learn by their own experiences

- allow for a lot of customization through users (both parents and children) but with a guiding default setting

Reflections on our approach

At the beginning we struggled a bit to make the teens understand what our application would be able to do. None of the kids had made financial transactions with their smartphone before, nor used a banking app in general. The video was an important aid in explaining that, but also influenced them later on.

The teens were concentrated and creative for a long time, which means that the tasks were interesting enough to keep them going.

At times it was hard to extract meaningful insights from the conversations, as the participants were overall very agreeable. We tried to encourage critical thought but often struggled to find out what they thought was a bad idea.

Project Highlights